Everyone has different needs. Investments that may be ideal for others may be totally wrong for you.

Consider What Sets You Apart

- What you are investing for – If you’ll need access to your funds soon—say, for a college tuition payment or a major purchase, you’ll want to invest conservatively. But if you’re saving for retirement and have many years to go, you can usually invest more aggressively.

- Risk tolerance – Your attitudes toward risk—and your behavior when the market changes—should guide how you invest, so you can invest consistently and sleep at night. When a portfolio is riskier than you can stomach, you’re more likely to sell when the going gets rough. And, as we know, poor investment timing can be very costly. You’ll want your portfolio to suit your risk tolerance.

- Other investments – You invest in many ways that you might not even think of as investing. You may own a house and so you’re already invested in real estate. If you work for a publicly traded company you may not want to buy more of its stock directly or through a mutual fund or ETF. Why? Because if your employer does poorly, you may lose your job—do you also want to lose your investment?

- Personal values – Many of us have values that we care about and that matter to us. We’d prefer not to invest in specific industries—perhaps alcohol, tobacco, gambling, or weapons. You should know what you’re invested in—and have the ability to avoid investments you find objectionable.

Make It Work for You

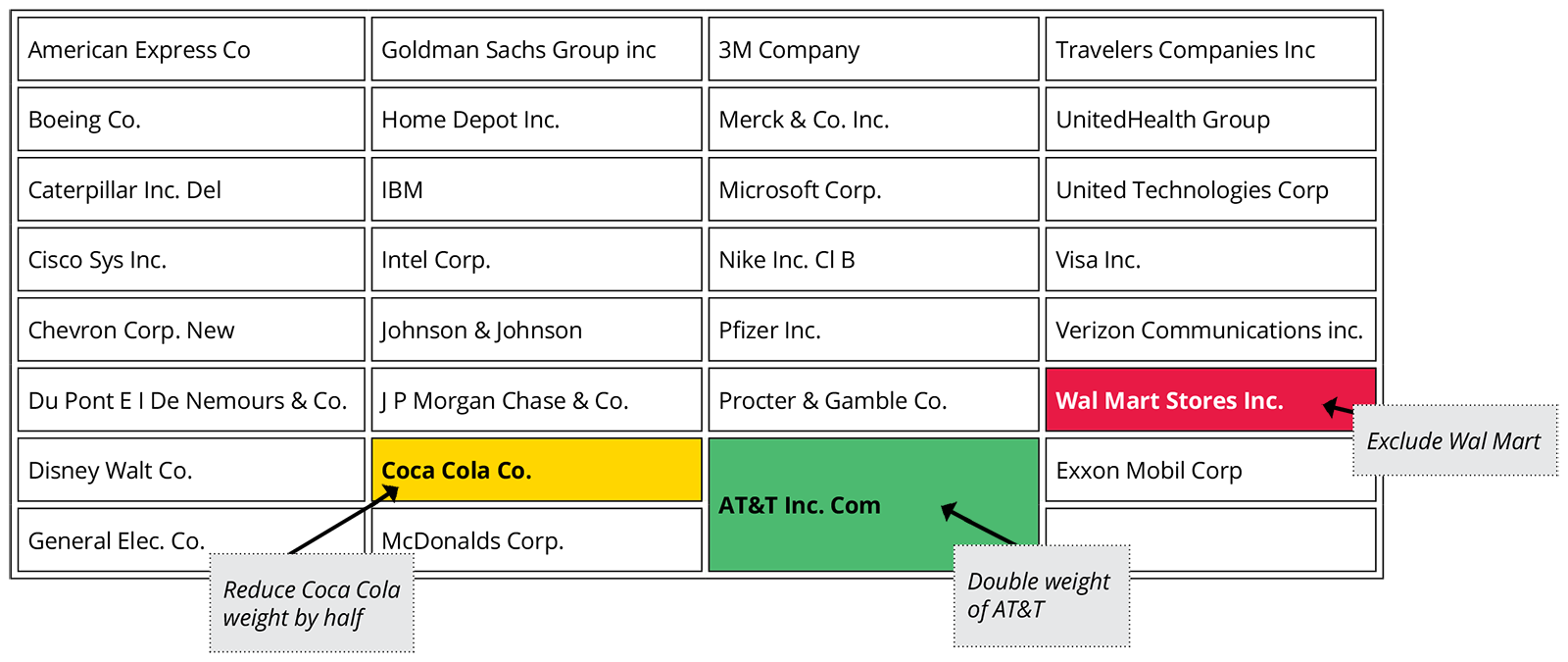

With folios—you can tailor your investments to what you want. Say you’re interested in a portfolio of large-cap stocks. The Folio 30 is one Ready-to-Go folio that might interest you as a starting point. If it’s not perfect for you as-is, make whatever changes you want. You can’t do that with a mutual fund or ETF.

We Give You Transparency and Control to Customize

- Add or remove securities from our Ready-to-Go folios. Or build your own folios with the stocks, ETFs, and mutual funds you want.

- Use automated filters to exclude specific securities or entire sectors.

- Use our socially responsible investing filter to avoid industries such as alcohol, tobacco, gambling, or weapons.

- As securities in your folios change in value, use one-click rebalancing to keep the right weighting.

- Use our patented tools for tax management and proxy voting.

- Own the securities you want in the amount that’s right for you—even fractions of shares.

Whether you invest using Ready-to-Go folios or build your folios from scratch, you can match your investments to your needs.