Paying less tax means keeping more of your money to spend or re-invest.

Everyone knows this, but many investors don’t do anything about it. Tax management seems complicated, time consuming, and hard to do. We understand. That’s why we designed our platform to make the entire process easier and faster.

With folios, you can tax loss harvest by selling poorly performing securities before the end of the year and defer selling winning stocks until later. You can pick from short-term losers, and push off winners until they become long-term gains. Or you can develop your own strategy to balance gains and losses to raise cash with no taxes at all.

You can’t do that with a mutual fund. Fund investors have no control over how and when fund managers trade in a fund. By law, mutual funds must distribute all realized capital gains each year, and they’re prohibited from distributing any losses. If your fund is held in a taxable account, you could end up owing tax on the capital gains distributed by a fund, even though your investment in the fund is showing a loss.1

Here’s just one example of the tax advantages of investing in folios:

Imagine two taxable accounts—one invests $50,000 in a mutual fund and one invests $50,000 in a folio containing the same stocks as the fund. Each appreciates 10% overall to $55,000, although some of the stocks fall in value. Now you want to sell some of the investments to take out cash—say $11,000 (to make the math easier).

| Mutual Fund | Investing in a Folio of Stocks and ETFs |

|---|---|

| You sell $11,000 of the fund. | You sell $11,000 worth of stocks, selecting the tax lots that declined in value or did not appreciate. |

| You have no choice but to realize a capital gain of $1,000 ($11,000 proceeds less the $10,000 basis). | You realize a capital loss. |

| You may have to pay a capital gains tax on $1,000. | You owe the IRS nothing, and may have losses to offset other income. |

Overall, both investments performed the same, but with a folio you may have more control over when you realize a capital gain.

We Provide Tools That Help You Stay on Top of Tax Management All Year Long

Automated Tax Management Strategies – Choose from 10 different tax strategies for selling your securities. One click automates the entire process. For example, you can select tax lots to minimize gains and maximize losses based on the specific capital gains rates that apply to you, or select from one of the other options. It’s up to you.

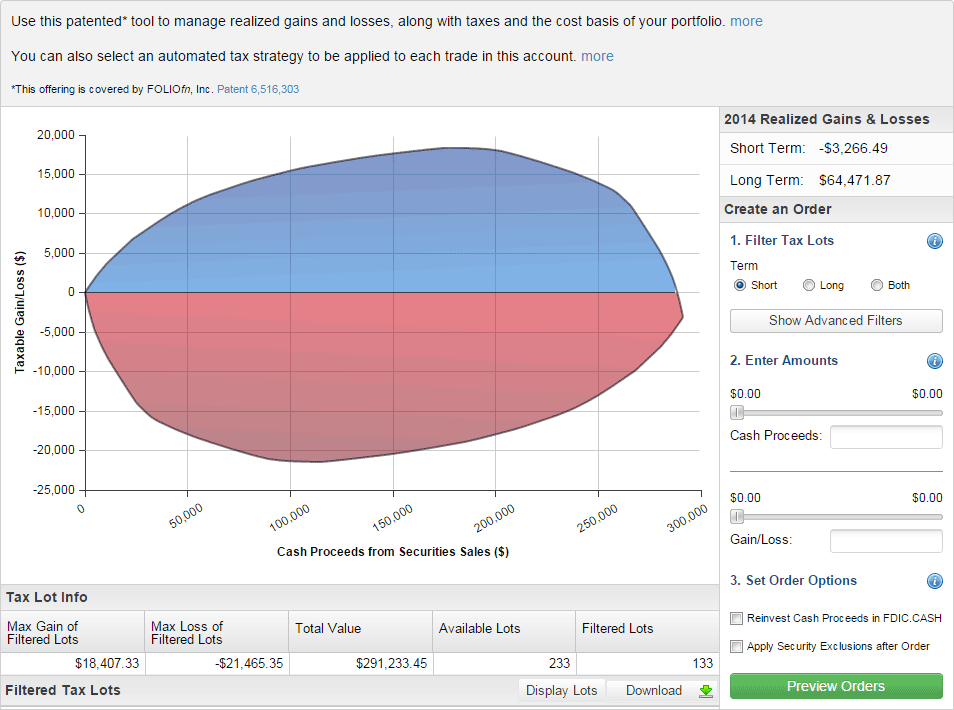

Tax Football™ – Our patented tool gives you unprecedented control combined with simplicity. In just a few clicks, you can automatically generate an order to raise cash and achieve the tax results you want, while making the most of your realized gains and losses.

Tax Records – We provide complete, downloadable, short- and long-term gain and loss records to make filing with the IRS easier.