Diversifying your investment portfolio matters. A lot.

Estimates vary as to what under-diversification costs investors. Some studies conclude it reduces an investor’s lifetime wealth by 20%.1 Others put the costs between 30% and 50%.2 How incredibly wasteful.

What Is Diversification?

When you diversify, you spread your investments across different securities. That helps reduce the risk from any one security. The less “correlated”—in other words, the less similar—the securities, the better. If most of the securities in your portfolio move in the same direction because, for example, they are all in the same industry or impacted by the same risk, then you’re not benefitting from the full power of diversification.

The idea is simple: If you concentrate, you increase your risk, but you don’t increase your expected returns—those are the returns you expect based on history and experience. If you diversify effectively, you reduce your risk without sacrificing expected returns. More importantly, for any given level of risk, if you diversify effectively, you can actually increase your expected returns (see below). That’s something you really want to do.

Why Diversification Works

Say you’re offered a single coin flip. If the coin lands heads, you win $150,000. But if it lands tails, you have to pay $100,000. Now let’s assume $100,000 is all you have—and if you lose, it means losing your retirement savings, or your kids’ college fund, or your house.

Would you take the bet? Most of us would pass. Even with 50/50 odds that you’ll come out way ahead—you simply can’t take the risk that you’ll lose. So you won’t play.

But what if you’re offered something similar—but different in one key aspect? This time you can flip the coin 100 times instead of just once—and win $1,500 for each head and lose $1,000 for each tail. Now, you’ll almost certainly play—and make money.

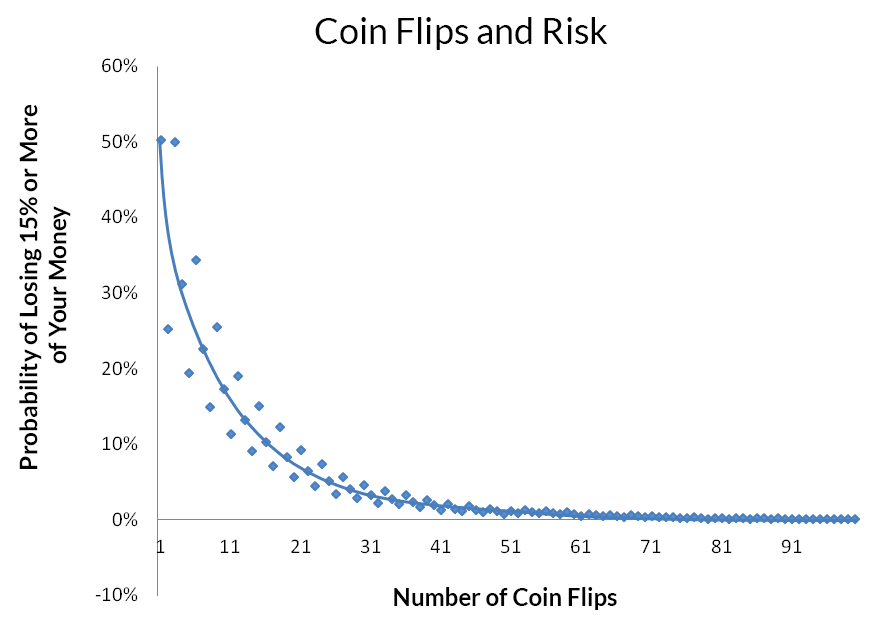

Why? Because that many coin flips reduces your risk of losing money, as illustrated in the graph below.3 By the time you get to even 50 flips, your risk of losing money in this example is almost zero. By “diversifying” your coin tosses, you reduced your risk.

Real-world investing is not flipping coins. It’s serious business and you want your investments to work hard for you. Diversifying helps do that. Investment performance data prove it.4

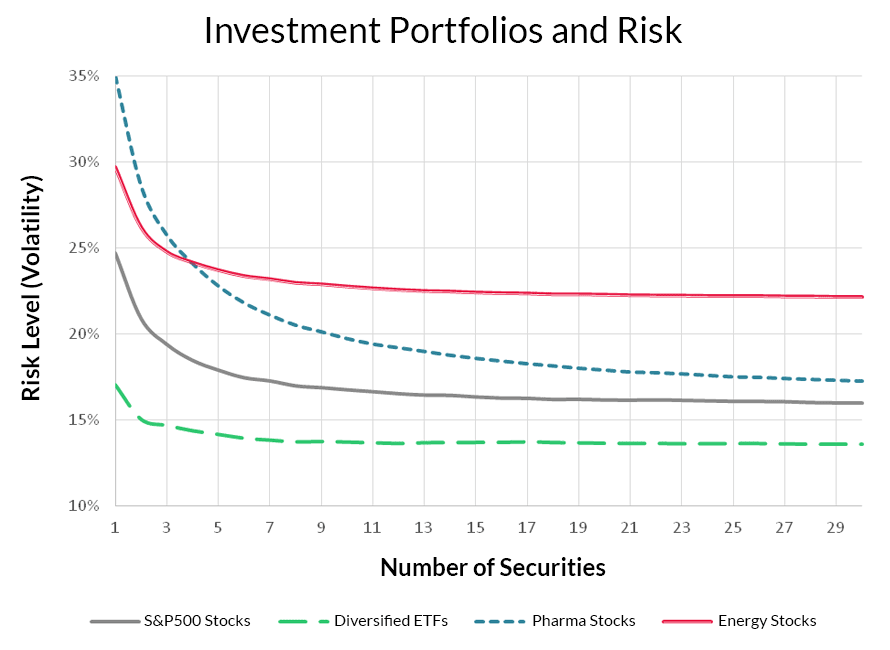

This chart shows how risk falls as you increase the number of securities in your portfolio.5

Even more: diversification increases expected return for the same level of risk.

More interesting, no matter what level of risk you’re willing to accept, you can increase your expected returns by diversifying.

Let’s change games. Say you’re given a standard six-sided die from your normal game of dice with these rules: roll anything other than a 6 and you’ll lose $1,000. But if you roll a 6, you’ll be paid $8,000. This die has twice the expected return of the coin you were just flipping—a 50% expected return as opposed to a 25% expected return (see here for the math).6 But, it’s much riskier. In fact, the odds of a winning roll of the die are just one out of six—compared to a winning coin flip of one out of two.

So, you have a higher expected return, but with much greater risk. What can you do? Diversify! With a hundred rolls of the die you will have basically removed the risk, but retained the higher return.6,7

Diversification is more than just owning more securities.

The risk level of any portfolio depends on what it holds, and diversification cannot eliminate all risk. If you own many securities in the same industry, or selected because they all fit one theme or idea, diversification allows you to reduce the risk that any one particular company will undergo trouble while the whole industry or the theme does well. But if the whole industry or the investing theme suffers a setback, that level of diversification won’t have helped.

Look at four different portfolios, each holding 30 securities. They’re very different in terms of risk—and diversification.8 The more concentrated you are in a particular sector or industry—or any particular theme or idea—the more diversification benefit you’re sacrificing. You can concentrate to take a specific gamble—like betting on a specific number in roulette—but don’t confuse that with smart investing—that’s just believing in your own good luck. By adding more diversification, you lower your risk .

_19Nov2014.png)

Even the S&P 500 is not as diversified as you may think. It’s almost entirely U.S.-based, large-cap companies. In fact, nearly 20% of the S&P 500 Index value is driven by just 10 stocks.9 That makes a big difference in its ability to deliver diversification.

Diversification That Works for You

A well-diversified portfolio can include different types of investments. How you invest is based on your tolerance for risk, the length of time you have to reach your financial goals, your specific interests and needs, and other factors.

Building a diversified portfolio that works for you doesn’t have to be difficult.

Let us help you or get started on your own account.